A common misconception among most retail investors is that bond investing is only for the very rich, very old or very conservative.

Actually it takes only RM250,000 to invest directly in bonds, while for RM500,000, you can have a bond portfolio managed by professionals.

Not exactly pocket change, but certainly affordable to those who are priority banking clients. Investing in unit trust bond funds of course starts with only RM1,000.

Bonds today are far from being a household investment among retailers, with most Malaysians remaining fixated on equities. As fixed deposits are deemed sufficient for savings needs, bonds are left to straddle the “no man’s land” between the two.

This is quite a shame as bonds hold so much promise in catering to the needs of investors, conservative or otherwise.

Yet its potential remains largely latent, as the penetration of bond ownership among Malaysians, even those with high net worth, remains very low despite the pace at which the bond market has developed.

Bonds work on the principle that by disintermediating banks i.e. bringing borrowers and lenders together and cutting banks out as the middlemen, the spreads that the latter earns are also carved out and shared between the two.

Consequently, the investor earns a higher yield and the borrower enjoys a lower borrowing cost.

This ability to generate a higher yield traded off against a slightly higher risk, accords bonds their biggest appeal. For investors who can afford to hold bonds to maturity, the main risk is credit risk, risk of issuer defaulting on interest or principal payment. This may be higher than that of a bank, although not necessarily always so.

The risk gap between bonds and fixed deposits (FDs) is often not that wide. Historically, the incident of default for A-rated bonds has been insignificant except for a spike in 1998 during the Asian crisis.

Default of AA bonds is extremely rare, while AAA bonds have never defaulted before. Given these favourable odds, credit risk can be reasonably managed with proper selection and monitoring.

In many ways, bonds are very similar to FDs. Both are fixed-income instruments – returns are known in advance if held to maturity. They provide regular income and depending on the bond rating, are able to satisfy the principal protection needs of investors, at least for the conservative part of their portfolio.

In my opinion, bonds are close substitutes for FDs, yet better on several counts. Returns are almost always superior, providing an inflation hedge. Also, investors are able to strive for higher yields by assuming credit or interest rate risks.

FD rate differentiation among banks tends to be fairly low, and even with longer tenures, the yield pick-up is usually not substantial. Further, interest from bonds is tax-free for individuals, unlike FD interest where there is a 5% withholding tax for FDs of more than RM100,000.

Investors who need to borrow money can pledge their bonds as collateral for loans, similar to FDs. The advantage though, is that they can actually make money by doing so via a reverse repo facility, using the proceeds to invest back in bonds and earn a yield higher than borrowing cost. He cannot make such a gain putting the money in FDs.

Bond investors who need to raise funds by selling their bonds will not lose out on interest accrued up to the date of sale, as the interest is built into the selling price. Fixed depositors will, however, lose the bulk of their accrued interest if FDs are uplifted early.

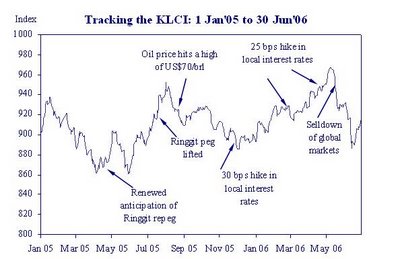

There are, however, some areas aside from credit where bonds are riskier than FDs. Investors who sell their bonds instead of holding them to maturity face interest rate risk i.e. the possibility of the bonds’ value falling when interest rate rises.

This risk has traditionally been manageable given our stable interest rate environment, save for the Asian crisis. Investors who do not sell their bonds will not incur realised losses, but there would be an opportunity loss as they could have obtained higher yields buying the bonds later.

Another risk faced by bond investors is liquidity risk. Because some bonds are not actively traded, there are occasions when investors cannot sell simply because of a lack of demand.

Once again, this risk crops up only if the investor has to sell pre-maturity or if he intends to trade in bonds rather than have a buy-and-hold strategy.

Because there is volatility in bond prices unlike FDs, it is an investment rather than a savings instrument. Just as there is a risk of bond values falling when interest rate rises (or credit quality deteriorates), there is also an opportunity to gain when interest rate falls (or credit quality improves). Investors who can time the market can enhance their return beyond simply earning a yield from holding bonds.

Given the widely shared belief that our interest rates have peaked or are close to peaking, interest rate risk is currently low compared with before. If anything, there is probably a greater likelihood of bond values rising when interest rates start to soften over time.

One can also invest in bonds via unit trusts and discretionary funds. The former’s advantages are that it requires only a small investment for investors to afford diversification and professional management.

The additional risk though is the volatility of returns during periods of massive redemptions. Investing via discretionary bond funds helps overcome this disadvantage, but the minimum investment is higher.

Bonds offer one of the highest returns per unit of risk as one moves up the risk-return curve.

I believe ownership of bonds by individual and corporate investors is likely to grow significantly over time as conservative investors grow increasingly aware of its benefits, while moderate to aggressive investors learn to appreciate that bonds and equities are not mutually exclusive in a portfolio but should co-exist to achieve diversification.

IN this article, CIMB Private Banking YEOH KIAT SENG demystifies bonds and reveals why Malaysian investors, conservative or otherwise, should not shy away from an instrument that has strong potential for good returns.